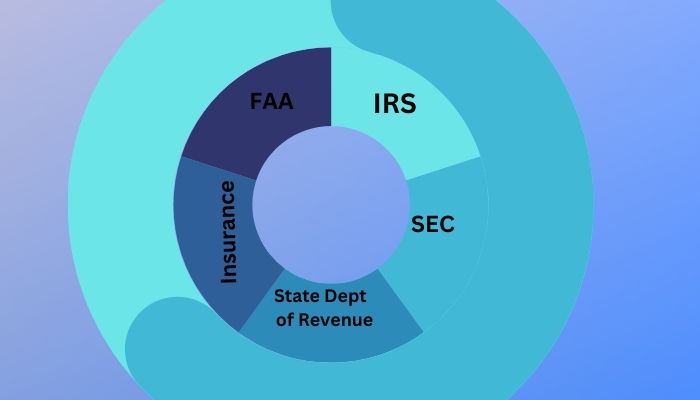

It is important to be aware of and comply with applicable law and the regulations of governmental agencies (FAA, IRS, SEC, state department of revenue) and the insurance policy.

FAA

There are regulations for how to register a business jet and how to operate a business jet. Regulations change and your facts change. Periodically review your registration and operations to ensure they remain in compliance. FAA civil penalties may exceed $11,000 per flight for aircraft operations providing transportation not permitted by the Federal Aviation Regulations. Many civil penalties are imposed on a per-flight basis so the penalty can be hundreds of thousands of dollars. Reputational risk can also occur if the FAA issues a press release about a significant proposed civil penalty that is being pursued against the company and the press release is picked up by local and industry publications.

IRS

If the federal excise tax (FET) applies to a flight, but the FET is not collected and remitted, the FET, interest and penalties for noncompliance may be imposed by the IRS.

SEC

The SEC requires reporting of any perk/benefit to executives and of related party transactions. Make sure your SEC counsel knows that there is a business jet and if the business jet is used for personal use by any executive.

State Department of Revenue

A State Department of Revenue may impose additional tax, penalties and interest or file a lien on the aircraft if the aircraft operations do not meet the requirements under which the company claimed an exemption from tax. These liens are difficult to remove, take time to remove and likely create a default under any financing.

Insurance Policy

There is risk of the insurance company denying coverage if a claim is made and the aircraft was not validly registered or the aircraft operation was not in compliance with the Federal Aviation Regulations.

Time spent periodically reviewing your aircraft registration and operations in connection with your flight department, aviation counsel, and tax advisor will result in a business jet that meets your needs and which is owned and operated in compliance with applicable regulations.

The information provided here is not legal advice and does not purport to be a substitute for advice of counsel on any specific matter. For legal advice, you should consult with an attorney concerning your specific situation.